In recent years, we’ve seen good progress embedding sustainability into the economy.

But we need to go further. We need to move beyond practices that limit harm, to an economy that’s regenerative. One that restores nature, values resources, and promotes climate resilience alongside an equitable society.

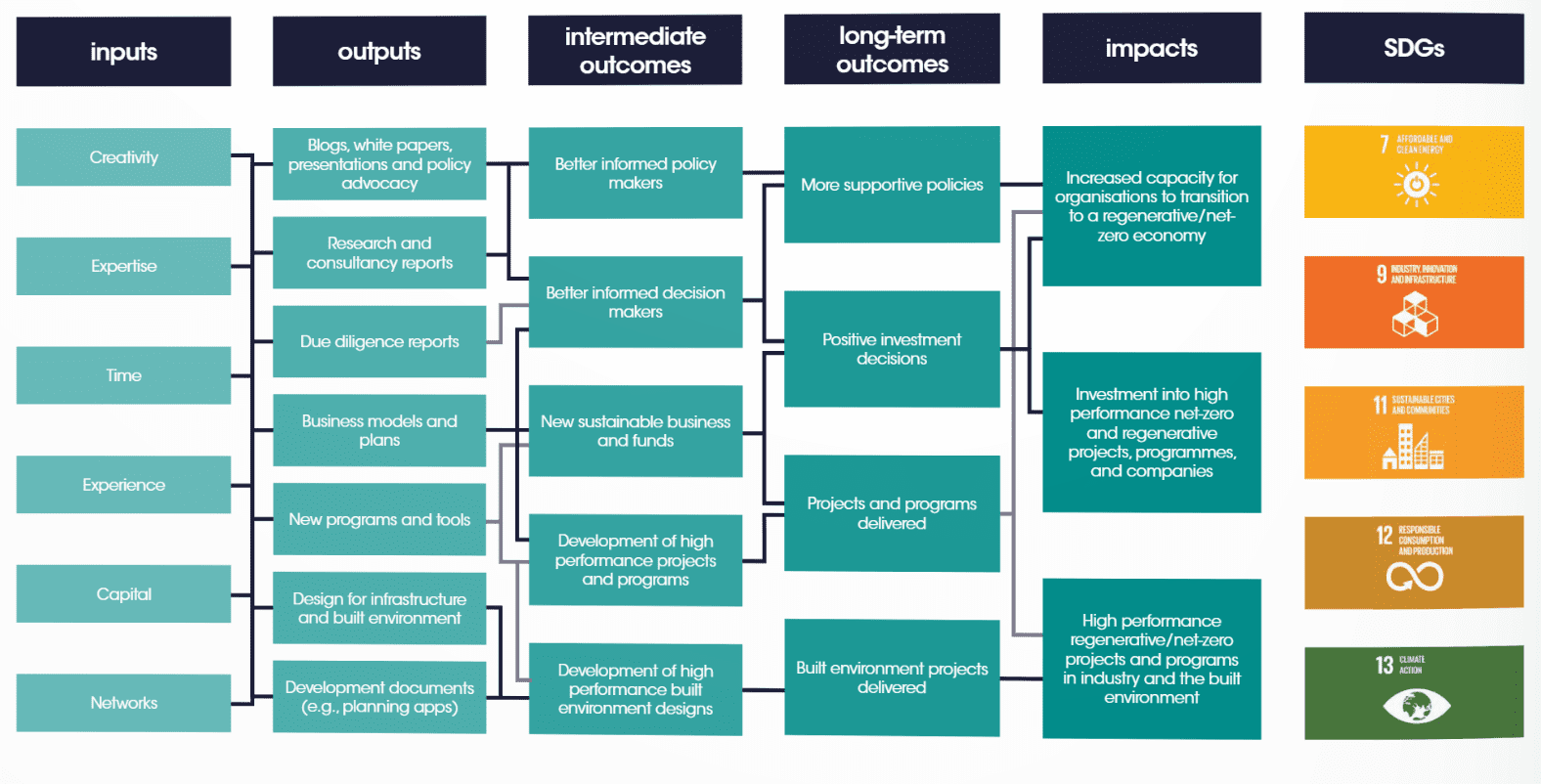

As an impact-led organisation, our mission is to drive the shift towards a net zero and regenerative economy.

Through the work of our companies, we’re starting to see the impact of our efforts, both in the UK and beyond.